Home > Resources > Newsletters > BFSI Vue

26th September 2024

Paperwork and propensity—same old loan game?

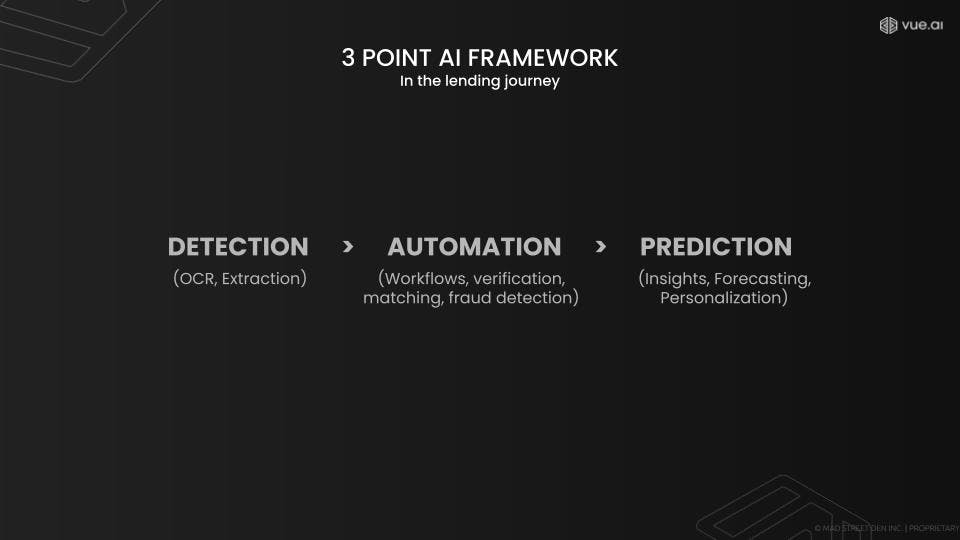

Due diligence ends with repayment, but the real work begins at delinquency. By implementing Extraction, Automation, and Prediction, enterprises can address longstanding challenges while unlocking new opportunities for growth and innovation.

In a bold leap, AI has dismantled and turned the tables on traditional loan processing inefficiencies — replacing under performance with foresight, turning raw data into razor-sharp decisions. Sketching a structured 3-step framework — Extraction, Automation, and Prediction — AI is reshaping routine lending processes, bringing about a multifold increase in productivity. Senior leaders in enterprises stand to gain significant insights from understanding this AI-driven transformation, which addresses longstanding challenges while setting a new standard for operational excellence.

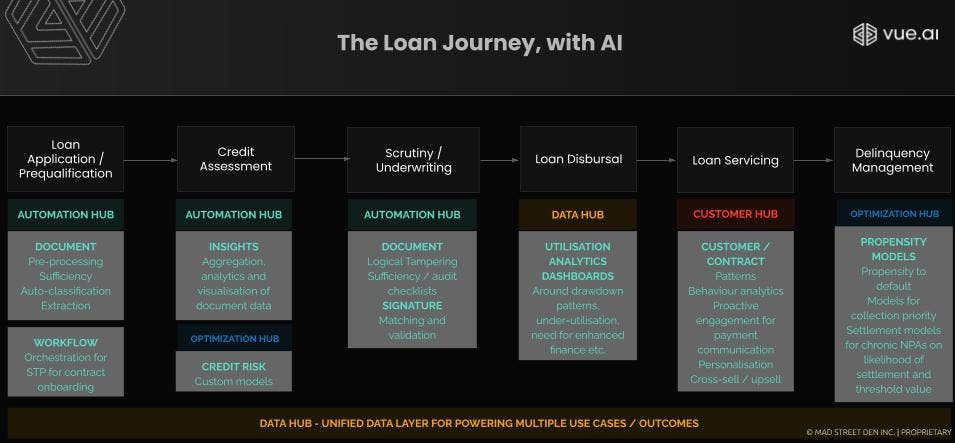

The Vue.ai orchestration platform powers the entire loan processing journey, spanning all the three stages and delivering outstanding results for enterprises; illustrative examples are noted under the sections.

See like a human, think like a computer

The initial step in the loan processing cycle, Extraction focuses on onboarding — a phase historically plagued by inefficiencies. The traditional method involves cumbersome paperwork, multiple touchpoints, and manual document validation, often leading to customer frustration and delays due to missing or improperly validated documents.

AI offers a robust solution by automating document pre-processing. Through intelligent data capture and machine learning algorithms, AI streamlines the upload, classification, and validation of documents, making the onboarding process quick and error-free. Both by reducing the time taken to onboard new customers and in minimizing errors, a smooth transition to the company’s system is enabled. By embracing AI at this stage, enterprises can enhance customer satisfaction and reduce operational costs, setting a strong foundation for the subsequent loan processing phases.

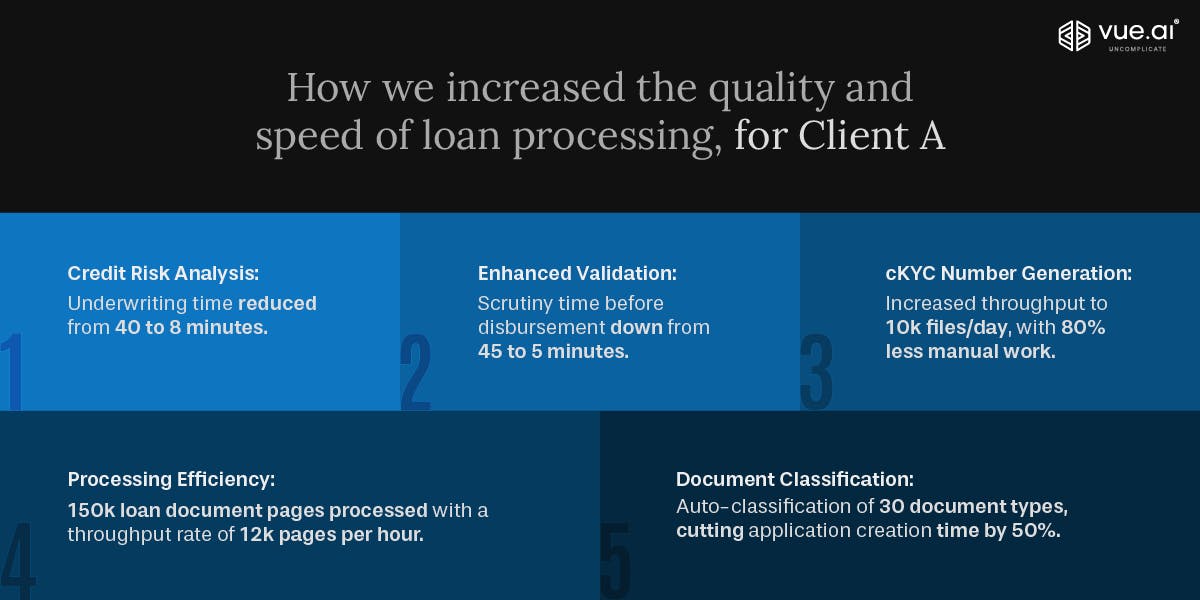

At Client A, a Non-Banking Financial Company, the Vue.ai orchestration platform…

(1) ... reduces by 50% the time taken to create an application, while auto-classifying 30 document types,

(2) ... processes 150k pages of loan documents, at a throughput rate of 12k pages per hour and

(3) ... generates cKYC numbers for 10k files per day, using 80% less manual work.

Safer the risk, higher the stakes

The second step, Automation, addresses the intricacies of credit assessment and verification (scrutiny). These are labor-intensive, heavy-on-manual-data-analysis processes, often resulting in incomplete evaluations. Missing data points or incomplete assessments can result in misguided loan approvals or rejections, increasing operational risks for insurers.

AI revolutionizes these processes by aggregating and visualizing document data, employing custom credit risk models that enable quicker and more accurate decision-making. By leveraging AI-driven insights, credit assessments become more comprehensive, reducing the likelihood of human error and oversight. Automated verification systems streamline the authenticity checks of documents, ensuring reliability and speed. This reduces the dependency on manual processes, allowing staff to focus on more strategic tasks and improving the overall efficiency of loan processing. Additionally, AI systems can automate market analysis and document scrutiny. By cross-referencing uploaded documents with public and proprietary databases, AI algorithms can quickly verify document authenticity and market conditions, reducing time spent on manual checks.

Client A, the Non-Banking Financial Company, uses the Vue.ai orchestration platform to…

- ... accelerate credit risk analysis by reducing the underwriting time from 40 mins to 8 mins.

- ... cut down the scrutiny time from 45 mins to 5 mins.

Pattern analysis and drawdown: Making risk look good

The final step, Prediction, focuses on optimizing fund utilization and enhancing customer engagement. Inefficiencies in fund drawdown patterns and underutilization of available resources are common challenges in this stage. Additionally, traditional loan servicing methods often lack proactive customer engagement, missing opportunities to leverage behavioral data for additional services.

AI-driven utilization analytics dashboards provide real-time insights into fund allocation, enabling more effective and strategic use of resources. By analyzing drawdown patterns, companies can optimize fund utilization, ensuring that resources are deployed where they are most needed. Advanced analytics tools personalize customer interactions, identifying upselling opportunities and tailoring services to individual client needs.

Too busy to validate? Delinquency will find you.

Delinquency management is another area where AI proves invaluable. Predicting defaults and prioritizing collections have traditionally been challenging, with inefficient processes often leading to missed opportunities for timely intervention. AI propensity models offer predictive insights, allowing companies to anticipate defaults and prioritize collections more effectively. This proactive approach not only mitigates risk but also ensures better financial outcomes for the company.

Client B, a financial services provider in South Africa, has realized a 50x increase in decisioning efficiency – 95% of them faster than earlier – using the Vue.ai orchestration platform.

And, so…

Due diligence ends with repayment, but the real work begins at delinquency. By implementing the 3-step framework of Extraction, Automation, and Prediction, enterprises can address longstanding challenges while unlocking new opportunities for growth and innovation. For senior leaders, understanding and leveraging these AI capabilities is crucial in staying competitive and driving the future of financial services.

AI is the surgical scalpel, cutting through the red tape suffocating insurance processes. Embracing AI is simply enhancing our journey to a more efficient, modernized insurance landscape. Hear from Vishal Subharwal and other experts at REBUILD '24 Istanbul.

When the average cost to service a non-performing loan is 12 times that of a performing one, automating the loss mitigation process to make faster and more accurate decisions about loan modifications and other workouts makes eminent sense. Page 41 of Enterprise AI Transformation - A state-of-the-market Report has details. Dial in.